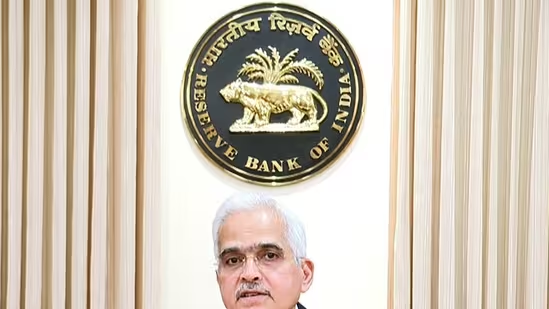

The Reserve Bank of India (RBI) kept key interest rates unchanged at their latest policy meeting, a move welcomed by both homebuyers and developers. This means borrowing costs will remain stable, potentially making homeownership more accessible for many.

Key takeaways:

No Change in Interest Rates: The repo rate stays at 6.5%, offering stability in borrowing costs.

Benefits for Homebuyers: Lower interest rates could make purchasing a home more affordable.

Positive Outlook for Developers: Stable rates are seen as positive for both luxury and affordable housing sectors.Industry Calls for Future Reduction: Real estate representatives believe future rate cuts could further boost the market.Global Market Influences: The European Central Bank’s recent rate reduction may pave the way for future cuts in India.

Experts’ Comments:

CREDAI President Boman Irani: Encourages RBI to consider rate cuts in upcoming meetings to stimulate demand.CBRE Chairman Anshuman Magazine: Positive news for future homeowners.

NAREDCO President G Hari Babu: Signals RBI’s commitment to economic stability.

Tata Realty MD & CEO Sanjay Dutt: Anticipates lower rates later in 2024.

Savills India CEO Anurag Mathur: Maintains consumer confidence and benefits the thriving housing sector.

Overall, the RBI’s decision provides a sense of stability for the real estate market, with the potential for future rate cuts adding further momentum.