The residential real estate sector in India is undergoing a significant shift. The time needed to sell the unsold housing inventory in the top seven cities—Delhi-NCR, Mumbai, Pune, Bengaluru, Chennai, Hyderabad, and Kolkata—has dramatically dropped from 2019 levels, according to a recent JLL analysis. This change, which reflects a strong rise in demand and effective inventory reduction, is an important advance in the housing market.

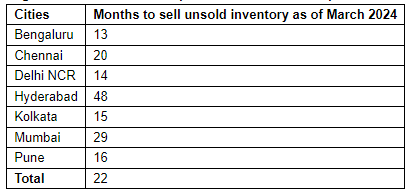

The average time to sell the unsold housing stock as of the first quarter of 2024 is 22 months, which is a significant decrease from the 32 months observed at the end of 2019. The main cause of this improvement is the exponential increase in housing demand that has been seen in recent years. Based on average sales rates over the previous eight quarters, the data highlights a steady upward trend in the market.

Nearly a million new homes have been introduced to the market in the residential sector over the previous five years, from 2019 to Q1 2024. As a result, by March 2024, the amount of unsold inventory that was being actively sold had increased to over 468,000 units, a 24 percent increase from December 2019. The shorter time it takes to sell these properties—despite the increase in inventory—highlights the market’s dynamism and robust buyer demand.

Chief Economist Samantak Das, Head of Research & REIS, India, JLL, outlined important developments in a number of market sectors. The time required for both the premium (INR 1.5 crore to 3 crore) and affordable (up to INR 75 lakh) segments to sell their unsold inventory has sharply decreased by about 43%. The decrease in the inexpensive group might be attributed to its declining share of new launches, whereas the premium segment experienced a notable decrease in selling time even though its share of yearly launches increased from 2% in 2019 to 22% in 2023. The inventory liquidation time for the premium segment decreased from 51 months in 2019 to 29 months in Q1 2024, indicating significant sales momentum in this market.

Remarkably, as of Q1 2024, the premium market still takes the longest to sell its unsold inventory—an average of 29 months. However, due to quick sales velocity and rising buyer demand in larger homes with more amenities, this market has shown a notable reduction in selling times.

There is a tendency in several places toward shorter selling times. With the time to sell unsold inventory falling from 48 months in 2019 to just 14 months in Q1 2024, Delhi NCR has experienced the most decline.

This is due to strong sales in the premium and luxury segments, according to Siva Krishnan, Senior Managing Director (Chennai & Coimbatore) and Head of Residential Services, India, JLL. He pointed out that several high-quality projects in Delhi NCR are selling out within days of their introduction. As the market continues to gain momentum, he expects additional reductions in the time it takes to liquidate inventories in the near to medium term.

The noteworthy decrease in the duration of unsold inventory sales points to robust demand and effective assimilation of both newly constructed and pre-existing housing stock in India’s residential real estate market.